No one likes to lose a customer. Aside from the emotional blow of losing business to a competitor, losing a customer is expensive. If you’re running a SaaS business, for example, acquiring a customer can cost upwards of $395.

And it costs five times more to go out and acquire a new customer compared to retaining an existing customer.

Understanding and managing your customer acquisition costs has a direct influence on your profitability. We’ll cover the pieces that make up your customer acquisition cost and how to calculate it, as well as practical strategies for lowering your customer acquisition costs by industry and channel.

Get brand new marketing strategies straight to your inbox. 23,739 people already are!

The Customer Acquisition Cost Formula

Your customer acquisition cost, also known as CAC, is the amount you pay to acquire a new customer. Typically, this is calculated as your total sales and marketing expenses divided by the number of new customers acquired. For example, if you spent $100 on PPC advertising to generate a sales qualified lead, and then spent another $200 for a sales rep’s time to close a customer, then your total CAC would be $300.

Your target CAC will depend on the type of business you’re running and your business model. For example, you could pay $300 to onboard a new SaaS customer while charging $100/month for your service. In this case, you’d break even on the acquisition cost three months after the customer started. If most of your customers stay a year or longer, this is great news. On the other hand, if most customers are leaving after the first month, you’re losing money.

This brings us to CAC’s crucial counterpart: LTV, or customer lifetime value. Lifetime customer value is exactly what it sounds like: how much a customer is expected to spend with you over their lifetime.

Why does LTV matter? Underestimating the value of your customers slows down growth. Rather than looking at your CAC or ROAS on a single-purchase basis, you can take your measurement a step further and use an LTV to CAC ratio.

Think of LTV:CAC as a number that behaves like ROAS, but instead of showing you the return on a transaction, it shows you the return on a customer. This number won’t mean much to you if your customers typically only have one large transaction with you, like a car or home. But if your customers make repeated or recurring purchases with you, LTV:CAC quickly tells you what kind of multiple you’re earning per customer.

There are two ways to increase profit per customer: optimize for lower sales and marketing costs, and find more ways to increase the lifetime value of a customer. Keep in mind: these are two completely different activities, but applying both will increase your profit per customer.

And remember: it costs less to retain a customer than to acquire a new one. If customers are leaving sooner than they should (or sooner than available cash permits), focus on retention first. Otherwise, no amount of CAC optimization will be sustainable.

Next, we’ll break down tactics for improving CAC and increasing LTV by a few different types of businesses: SaaS, eCommerce, and non-software lead generation.

Reducing CAC for SaaS Businesses

As we mentioned at the beginning of the post, you could pay almost $400 to acquire a customer for your SaaS business. For an enterprise SaaS business, your costs could include a multi-channel PPC budget, account-based marketing, email marketing, and an experienced sales team that’s able to guide your prospects through demo and trial stages.

On the plus side, you’re acquiring a customer who could stay for multiple months, if not years.

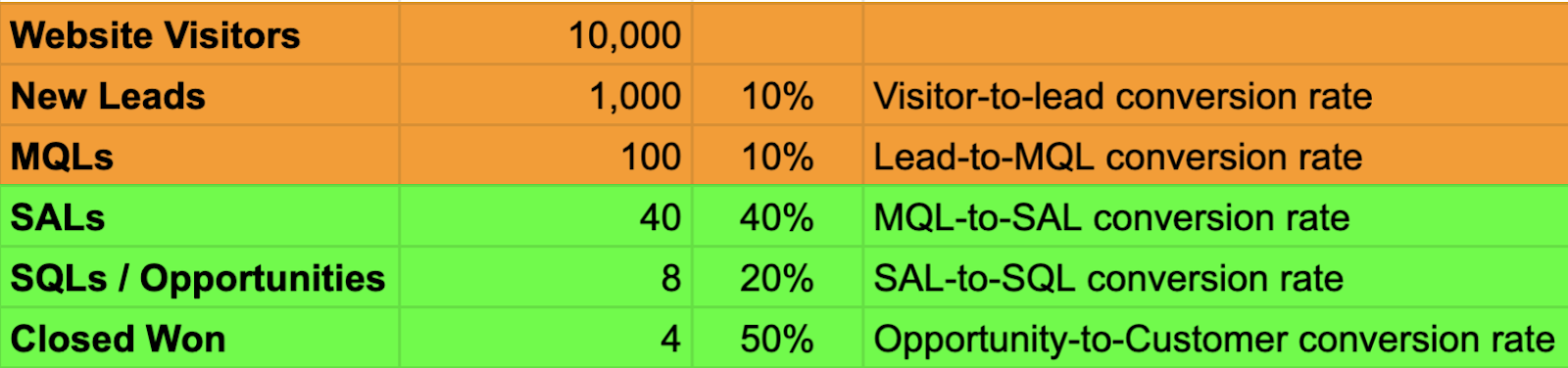

There are a few touchpoints that have strong influence on your CAC: visitor to marketing qualified lead (MQL), MQL to sales qualified lead (SQL), and SQL to paying customer. (There are plenty of ways to divvy up this customer journey, but we’ll stick with these four stages for simplicity.)

Measure The Full Funnel

SaaS sales cycles can involve many moving parts, and the last thing you want is to see sales expenses trending up and revenue trending down without a clear handle on the cause. To avoid this, identify your most crucial business metrics, and which actions affect them.

Knowing your conversion rates for each of these stages should make it easier to understand why the business is trending in a given direction, and to set specific goals for each stage. If your product has a freemium offering, that should be included in this kind of measurement so that you can spot opportunities to improve your monetization rate.

Know Who Your Customer Is and Where to Find Them

This sounds like common sense. But in the SaaS world, things can get nuanced very quickly.

Sure, maybe you’re a customer review platform. But if you’re a customer review platform for eCommerce businesses who make $2MM - $10MM per year and use Klaviyo, bidding on keywords like “customer review platform” or broad demographic audiences on Facebook may not be the best strategy to keep your CAC low. That kind of keyword intent or audience is too broad to reach a viable, paying customer every time.

Even if your product doesn’t have such a specific use case, speak to the most specific persona you can. One company saw 124% more visitors convert into leads after creating more specific content tailored to personas.

Breadcrumb Your Leads

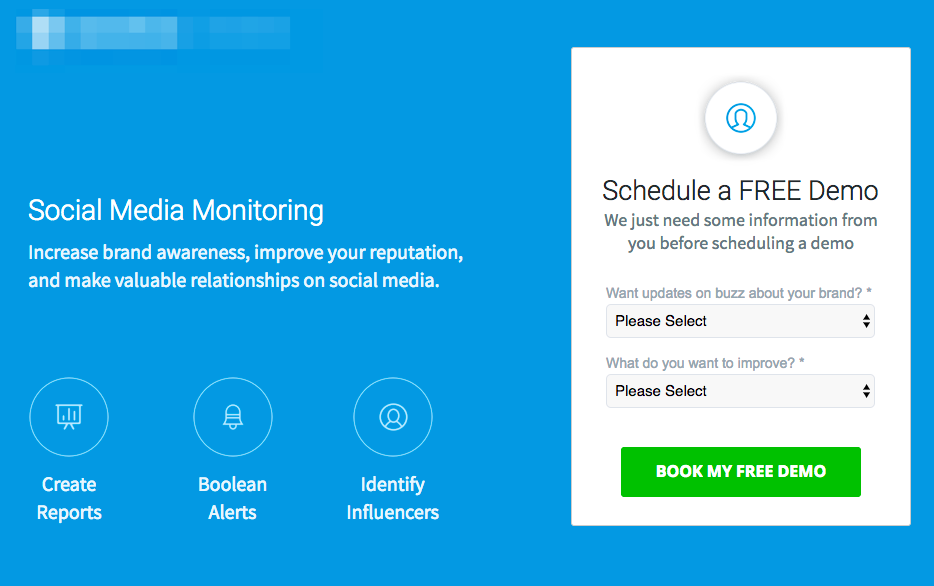

Fewer form fields aren’t always the answer. If you let prospects book demos with your sales team without getting a basic understanding of their needs, your sales team is going in cold.

Start off by asking questions about your prospects’ needs. They’ll want to share information about their context so they can find the best solution for their needs. And because these questions aren’t personal, there’s virtually zero friction added into the conversion path.

Once visitors are engaged with your less personal questions, they’re likelier to complete the form and give you their contact information. At KlientBoost, we call this the breadcrumb technique.

When executed well, you learn more about your prospects, and they’re more interested in giving you their contact information. It’s a win-win!

Diversify Your Marketing Efforts

Relying heavily on one marketing channel, like PPC, for the majority of your sales becomes like a game of Jenga: increasingly exciting and precarious. Record-breaking days of leads are exciting, but anomalous lows are a gut punch. Not every day’s traffic is equal. The best way to create stability is to diversify.

In the world of SaaS, content marketing, for example, can simultaneously do the job of educating your customers, positioning your brand as an authority, and offering an additional source of traffic through SEO that doesn’t require you to pay for every click.

Yes, SEO takes time. But if you haven’t made the investment yet, it’s like starting your first savings account: it won’t look like much on day one, but you’ll soon be glad you started when you did.

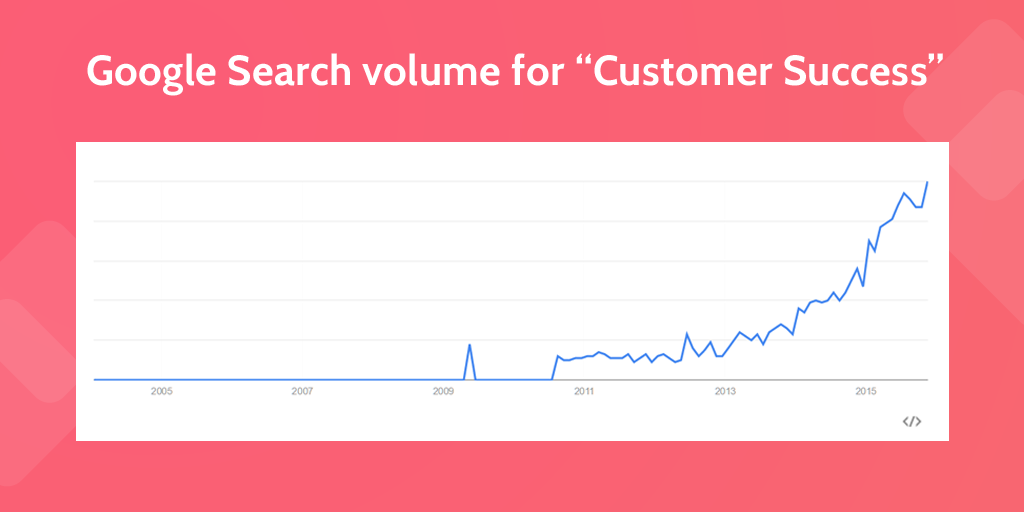

Have a Customer Success Strategy

Getting a qualified lead or even signing a new customer is great. But a churn reduction of just 4% can double your MRR. And, if you’re like most SaaS companies, you’ll want to ensure a customer stays for several months in order to see profit after the total cost of customer acquisition.

This is where your customer success team comes in. They should ensure that there’s alignment between the promises made by sales and the new customer’s expectations. They should also ensure that new customers are successfully able to use the software. Even the most user-friendly products have a learning curve.

Reducing CAC for eCommerce Businesses

If you’re selling goods online, you most likely don’t need a full sales team based in San Francisco to close deals. Most customers can buy simple and relatively inexpensive goods without help. But there’s a catch. Unless you’re selling a replenishable or subscription good, you likely won’t be making just one sale that renews itself for months on end. You’ll have to work for each and every sale.

That doesn’t mean you can forget about retention and assume it’ll just be easier to acquire customers endlessly. After their first purchase, a customer has a 27% chance of buying again. That number goes up to 45% after their second purchase. Existing customers are more likely to buy. But you’ll need intentionally designed strategies for both acquisition and retention.

Let’s start with acquisition and talk about a few crucial rules for minimizing CAC for eCommerce businesses.

Don’t Price Yourself Out of Business

In 2018, Amazon owned 49% of the US eCommerce market, and that’s still expected to increase. But you don’t need to copy their pricing strategy to have a strong business. In fact, if your average order value is less than $50, then your shipping costs and costs of goods sold can quickly catch up.

If your gross margins are 50%, for example, and your average order value is $50, then you’re left with only $25 to split between marketing costs, shipping costs, and your earnings. Without a strong retention strategy, customer acquisition costs could hurt your profitability.

Collect Reviews Relentlessly

If a customer clicks your ad only to land on a product page with zero reviews, it’s a turn-off. And 63% of customers are more likely to purchase from a site that has user reviews. If you’re not collecting reviews, you could be doubling your CAC.

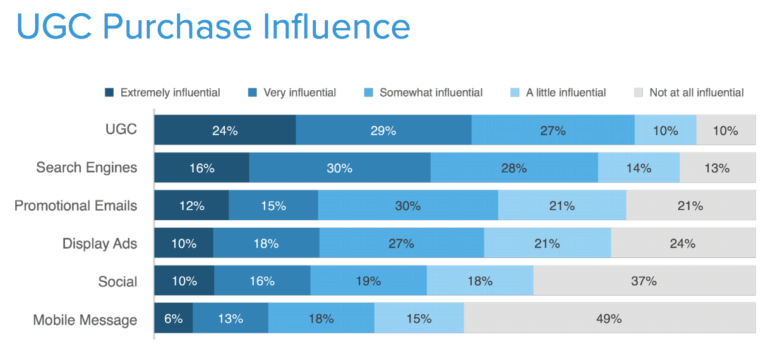

Incentivize Customers to Create User-Generated Content

It’s one thing to read a positive review, but it’s another to see a real customer who’s excited about their purchase and can show it works. This can’t be underrated: Yotpo found that people who engage with UGC convert 161% more often than people who don’t interact with UGC.

If you’re looking for a starting point, reach out to customers who have already left a positive review, and ask if they’d be willing to create a short video of themselves talking about their purchase and showing off your product.

Leverage Social Proof In Ads

Just as social proof in the form of reviews lends credibility to your website, comments and likes lend extra credibility to your Facebook ads. This is one of our favorite Facebook ad tactics; we call it dark posting.

Facebook measures the likelihood that someone will click, comment on, or share your ad with a metric called engagement rate ranking. Aside from the extra value people may get out of positive comments on your ad, having an average or above average engagement rate ranking can also result in lower CPMs (costs per thousand impressions), which can also lower your CAC.

Capture Email Addresses

The average eCommerce conversion rate in the US is 2.57%. That’s a lot of missed opportunity. But you can almost double this number with an email opt-in form that presents some kind of offer, like free shipping or 10% off. About 5% of visitors should opt-in.

Then, introduce yourself to your new subscribers with a welcome series. This is a series usually made up of three emails where you can tell customers about your brand, showcase best-sellers, and present the offer your subscriber signed up for.

Welcome series emails had the highest conversion rates at an average of 3.04% of four different types of email flows Klaviyo studied in this benchmark report.

Save Abandoned Carts

The average cart abandonment rate is 69.57%. Using email marketing to recover abandoned carts is one of the most straightforward methods to reduce your CAC. In their 2019 email performance benchmark report, Klaviyo found that 3000 customers were able to recover over $60 million in abandoned cart revenue within just three months.

And you don’t need to stop at just one email. Use a series of three emails to increase the odds of converting your new customer.

Reducing CAC for Lead Gen Businesses

If you sell some type of professional service for consumers or businesses, this is for you. In this context, reducing your CAC involves a few touchpoints: the total number of leads you get, how many of them are qualified, and your close rate. You may also have upsell opportunities or repeat purchase opportunities that can increase your lifetime value.

Make It Easy For Prospects To Reach You Immediately

People who are ready to buy are more motivated to pick up the phone and discuss options. Make it easy for them to get in touch with you! Make sure your phone number is clickable and keep it above the fold so that it’s one of the first things visitors see when the page loads. String Automotive saw call conversions increase 200% after including their clickable phone number above the fold.

Double down by making sure that the phone number you use is local for the caller—this is especially important if you operate in multiple locations. Engine ready ran a test between toll-free and local numbers and found that local area codes increased phone leads by 112.5%.

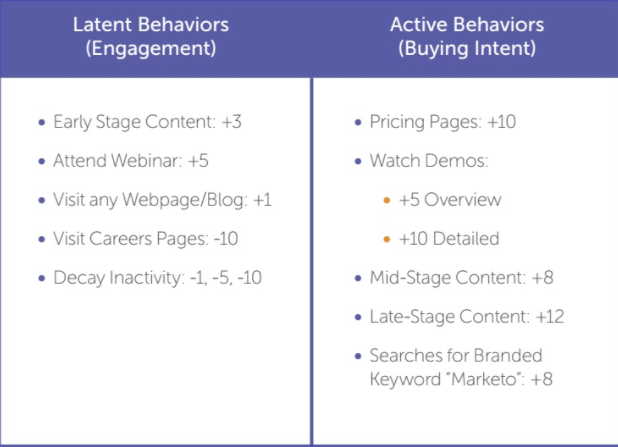

Use a Lead Scoring System

79% of B2B marketers don’t have an effective lead scoring system. If you’re in the same boat, this is a significant opportunity to better prioritize your sales process and lower sales expenses.

For example, if you know that someone who downloaded an eBook from your website with a business email address is a more qualified lead than someone who filled out a contact form with a personal Yahoo email address, make sure your sales team has a reliable system for prioritizing qualified leads.

For example, you could assign points like:

- Contact form submission: 3 points

- Has business email address: 3 points

- Downloaded eBook: 6 points

The amount of points you decide to assign is up to you. Use values that make sense for your business and adjust as needed.

Understand How Visitors Use Your Landing Page

Sometimes, visitors need thorough and detailed information to understand your service. But other times, people want quick answers or to get on the phone with someone. Use a heat-mapping tool to better understand visitors’ behaviors.

Epiphany, for example, found that mobile visitors were only scrolling through a small amount of the landing page.

After making some usability improvements, including a new filtering system at the top of the page, Epiphany saw a 63% increase in mobile conversion rate.

Let Your Customer Base Work For You

91% of B2B buyers are influenced by word of mouth. And you don’t need to go out of your way making one phone introduction after another to make this stat work in your favor. Are there any relevant influencers who’d be willing to write a quote or review for you? Do you have existing customers who are willing to do a case study based on the work you’ve done for them?

And more directly, do you ask your existing customers for referrals on a regular basis? Do you offer your customers an incentive for closed referrals? Consider this: if you’re willing to pay X amount to acquire a customer, why not offer your existing customers that much to refer someone who closes?

Track Closed Sales

Seeing the cost per conversion in an ad account isn’t always the best assessment of your marketing campaigns. For example, if you’re measuring cost per lead and not cost per sale, the metrics might be misleading.

Instead of guessing at the close rate behind your keywords, use a CRM to capture data from your ads and connect it to your leads. To do this, you can add hidden fields to you lead gen form and capture UTM tags or any other parameters from your ads that tell you where a visitor came from.

Then, in a CRM like HubSpot, for example, you can track the close rate of your leads by source or even keyword. With this kind of information, you can spot the difference between a keyword that simply brings in a lot of leads versus one that bring qualified prospects that turn into closed deals.

Remove Friction, Add Value

The less value you offer, the more expensive it’ll be to acquire a customer. If you’re a B2B SaaS company, this means giving your customers not only the information they need to buy your software, but ongoing support to ensure they’re able to use the software as intended.

If you’re a B2C eCommerce company, this could mean sharing reviews with potential customers, and showing them what it looks like to own your product through user-generated content from existing customers.

And if you’re generating leads for professional services, make it easy for prospective customers to get in touch with you quickly. Remove barriers in the path to conversion, and ask questions that show you can meet their needs.

Optimizing your conversion rate to reduce costs is only half the battle. You’ll make the most of customer lifetime value by finding new ways to make your customers’ lives easier through new products and better service.